Bay Area Market Statistics | December 2023

Market Update

Market Update

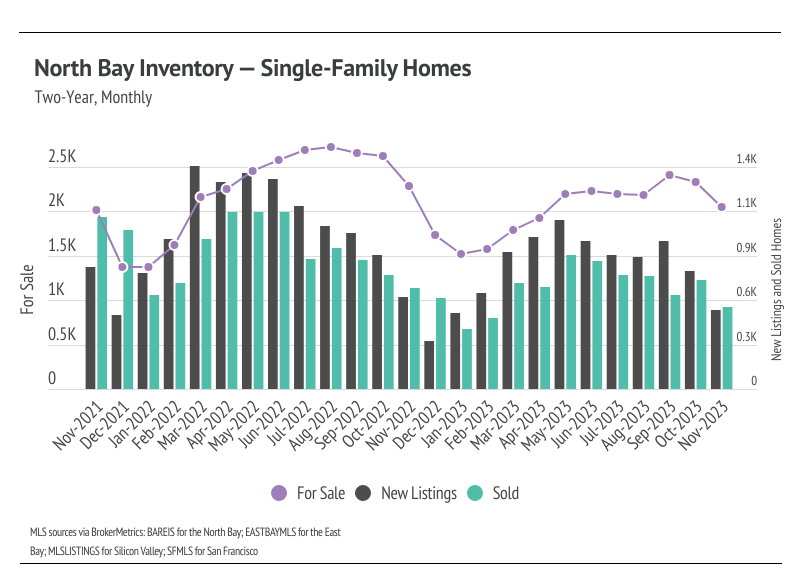

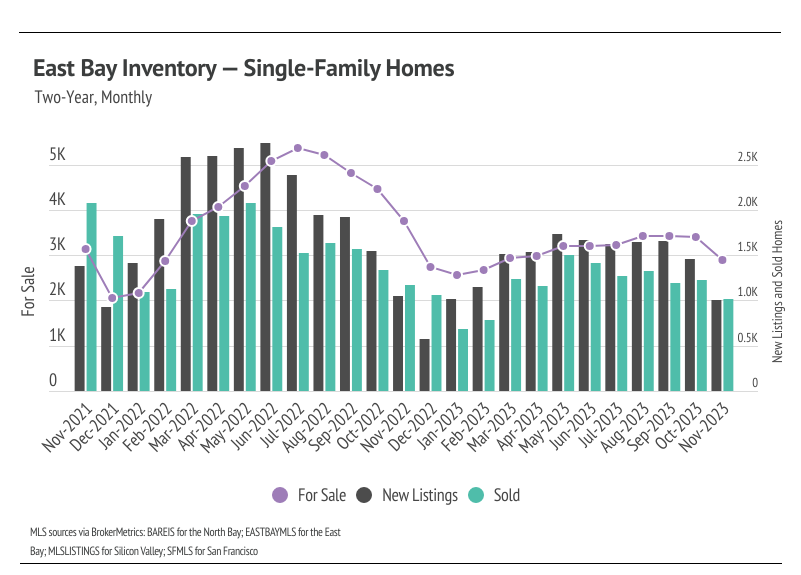

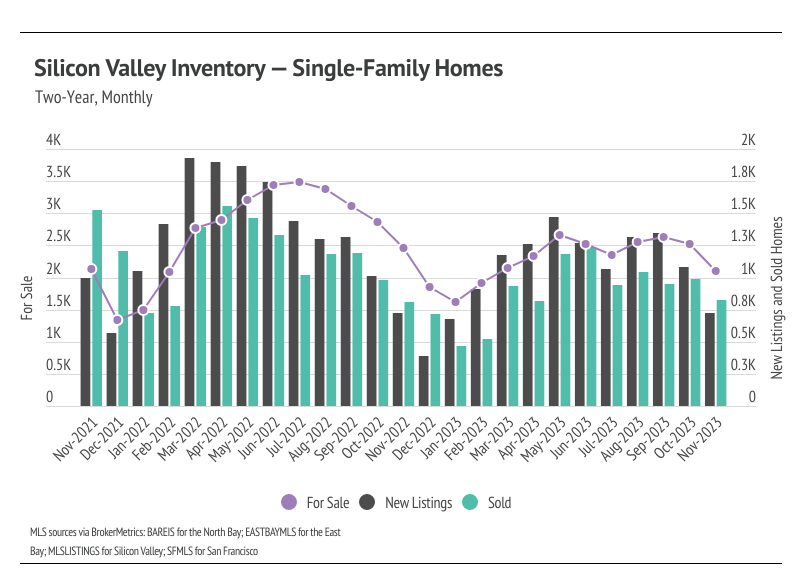

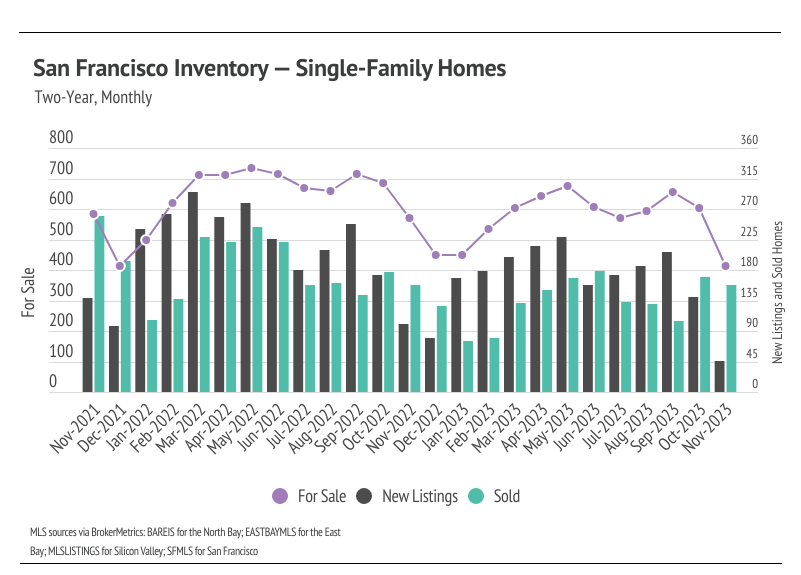

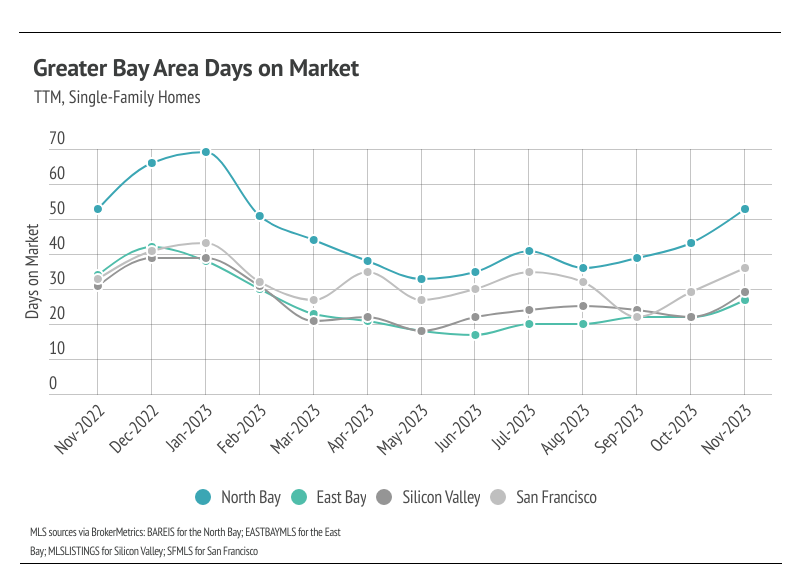

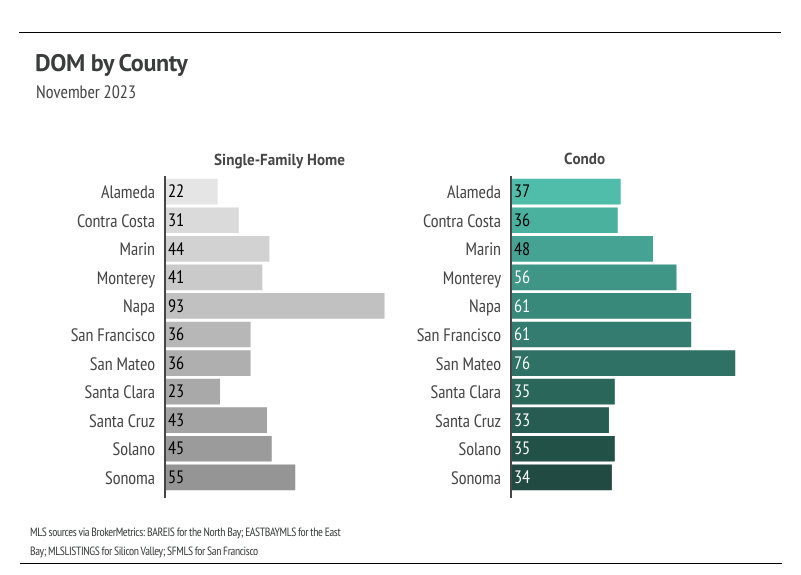

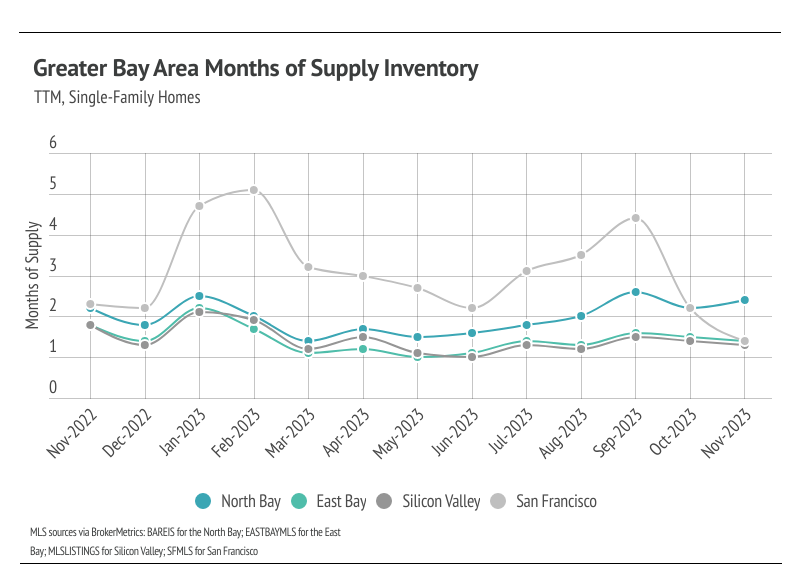

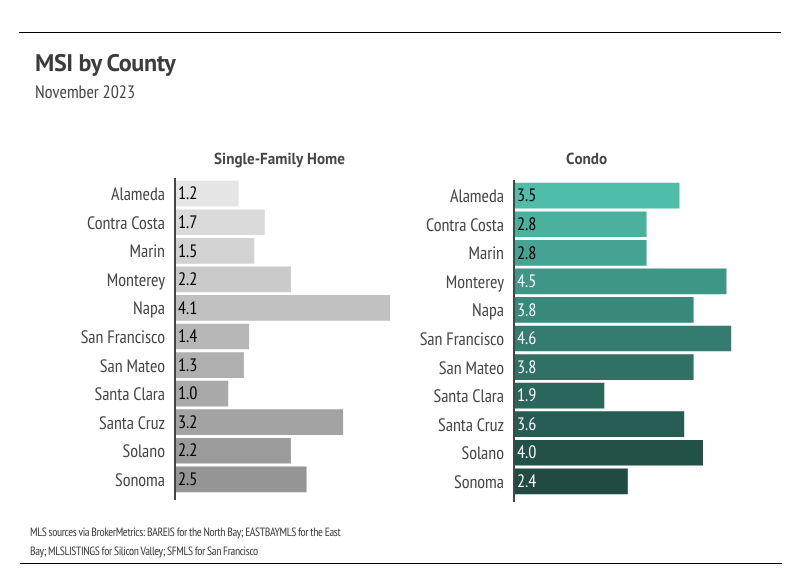

Welcome to the December edition of the Bay Area Real Estate Update! As we enter the final quarter of 2023, the Bay Area real estate market continues to be a dynamic and evolving landscape. In this newsletter, we'll take a closer look at the latest trends, developments, and insights shaping the market.

Stay up to date on the latest real estate trends.

August 31, 2024

August 2024

July 24, 2024

Median home price hits record high for the second month

July 3, 2024

Insights into the Bay Area Real Estate Market: June 2024 Market Statistics and Trends

May 28, 2024

Insights into the Bay Area Real Estate Market: May 2024 Market Statistics and Trends

April 24, 2024

Insights into the Bay Area Real Estate Market: April 2024 Market Statistics and Trends

April 11, 2024

March 18, 2024

Insights into the Bay Area Real Estate Market: March 2024 Market Statistics and Trends

March 18, 2024

February 23, 2024

Insights into the Bay Area Real Estate Market: February 2024 Market Statistics and Trends

You’ve got questions and we can’t wait to answer them.